How China’s Battery Cases Energize 70% of North America?

In the EV revolution, Tesla often steals the spotlight. Yet behind every sleek Model 3 and roaring Cybertruck lies an unsung hero: the humble battery case—sourced predominantly from China. Astonishingly, up to 70% of Tesla’s North American battery cases, and nearly 40% of its overall battery materials, originate from Chinese suppliers—vital for the production of its advanced lithium-ion batteries.

Beyond just raw materials, Tesla's reliance on Chinese suppliers permeates every aspect of its manufacturing infrastructure. Among Tesla’s approximately 13,000 battery-material suppliers, around 39–40% are Chinese, including major players like CATL and BYD’s FinDreams. These companies supply critical items—from cathode coils and casings to electrolyte and anode materials—that underpin battery functionality.

In particular, Tesla has begun importing cathode coils from second-tier Chinese manufacturers to its Texas plant to boost production of its new 4680 cells. These coils, which alone account for roughly 35% of a cell’s cost, are essential for scale-up efforts toward mass production.

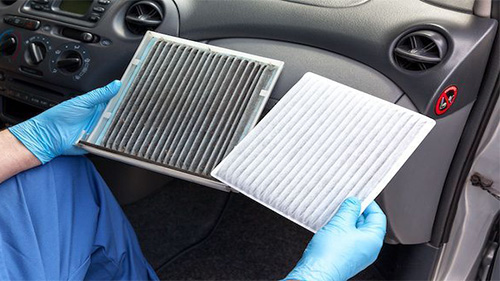

Battery casings do much more than protect cells—they manage heat, resist crash damage, and contribute to structural rigidity. These cases must pass rigorous safety and performance standards. Up to 70% of these enclosures for Tesla’s North American fleet are Chinese-made—an often-overlooked vulnerability.

Geopolitical Risks and Tariffs

In response to rising trade tensions, the Biden administration implemented steep tariffs—from 7.5% to 25% on Chinese battery parts and 100% on complete Chinese EVs—hoping to incentivize domestic production. Still, analysts point out that Chinese LFP batteries retain a significant cost advantage, even post-tariff.

These restrictions impact Tesla directly: its standard-range Model 3 and parts of the Model Y rely on Chinese-sourced cells, potentially increasing battery costs by up to $2,300 per pack—though Tesla may absorb these or shift supply sources.

China’s Dominance in Global EV Supply Chains

China isn’t just a supplier to Tesla—it controls over 60% of global EV battery production and 75% of all lithium-ion batteries worldwide. It refines over 80% of battery-grade electrolytes and 70% of cathodes, giving it deep supply-chain clout.

Even as U.S. and international players push for reshoring, analysts warn that decoupling from China is a massive, long-term project—made more complex by cost, expertise, and economies of scale.

Recommended for you: